Breaking Down Premium Inventory in CTV

Traci Ruether

Traci Ruether

9 minutes read

There’s a phrase that keeps popping up in streaming TV: premium inventory.

Every platform claims to offer it. Every advertiser wants to buy it. And yet nobody can seem to agree on what premium means.

Does it refer to a particular publisher? A content type? A clear demarcation across the blurring worlds of SVOD, AVOD, and FAST? Or something even more elusive?

Unfortunately, pinning down a definition is just the start. Once marketers do establish their criteria of what qualifies as premium streaming inventory, new questions pop up:

- What’s the best way to buy at scale across fragmented publishers?

- Can performance-based advertising and premium content coexist?

- How should budget be allocated across premium and non-premium buys?

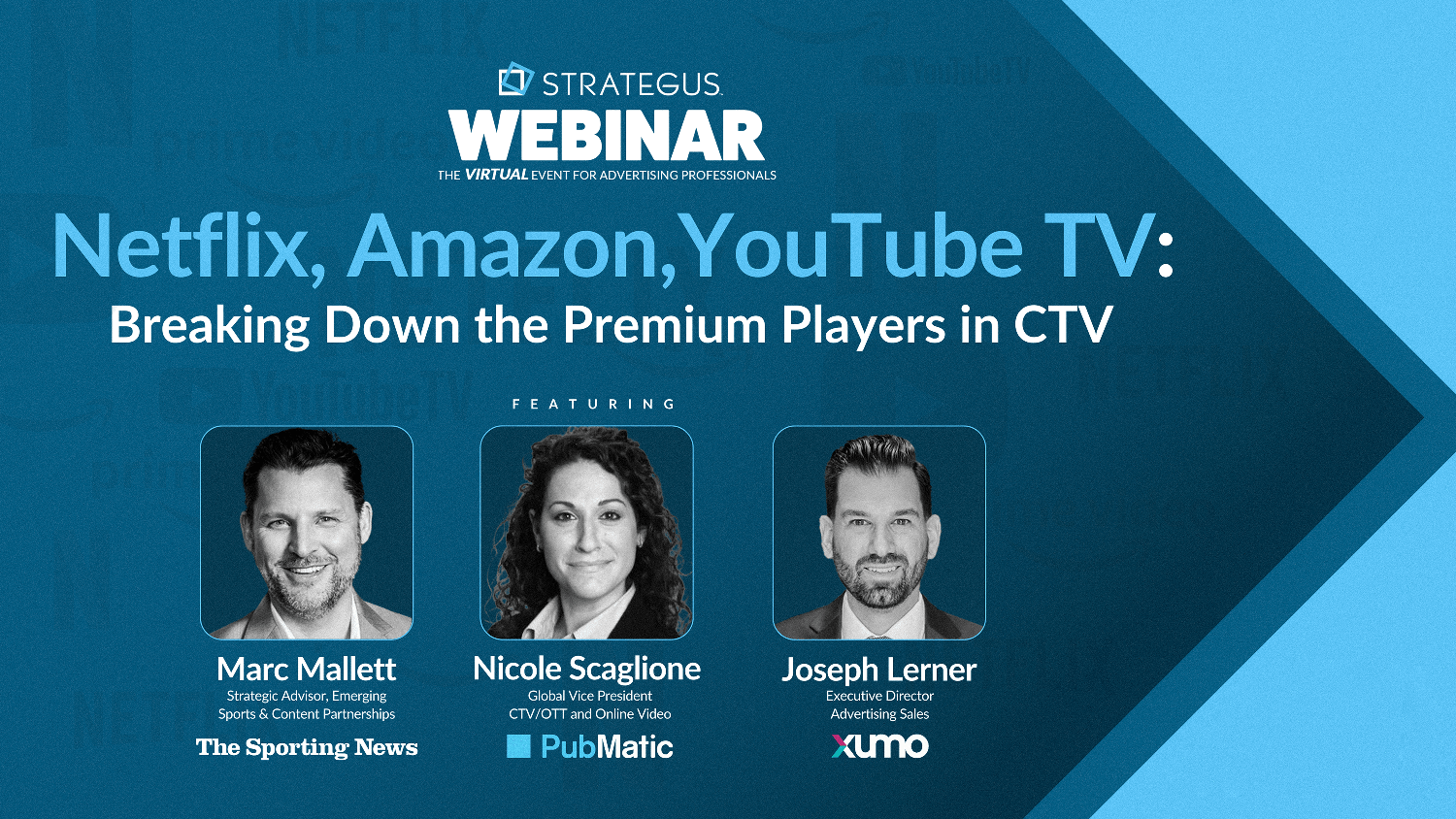

To offer guidance on this challenging topic, we recently hosted a webinar on premium connected TV (CTV) advertising. We invited experts from Xumo, PubMatic, and Sportiva to weigh in on these questions and more.

Watch the recording to get some much-needed clarity on the topic — or read the full recap below for guidance on approaching premium CTV in a way that drives results.

Premium Is in the Eye of the Beholder

In the early days of streaming, things were clear cut. Subscription services like Netflix gave viewers access to exclusive shows and movies that could be watched on demand. Only Hulu included ads at this stage of the game, and linear streaming channels weren’t even a thing.

A lot has changed since then.

Every major streaming platform now offers an ad-supported tier, and the service models span several categories today:

- Hybrid video on demand (HVOD). Ad-supported subscriptions to services like Netflix, Prime, and Disney+ fall into the HVOD category because they generate revenue through a mix of commercials and subscription plans. The ad-supported tiers appeal to viewers who want premium content without having to pay the high-end price tag.

- Virtual multichannel video programming distributors (vMVPD): vMVPDs like YouTube TV deliver linear TV channels (with ads) to paying subscribers. Households looking to cut the cord without losing access to live sports content and must-watch shows from popular cable networks are the target market for these services.

- Free ad-supported streaming TV (FAST): For viewers looking to do away with paid subscriptions altogether, FAST apps make it easy. These streaming services deliver linear channels at no cost to viewers — playing everything from reruns, old movies, platform-specific content, and local news. Many smart TVs (like Roku) have default FAST apps (like the Roku Channel) within the interface, giving viewers a free and easy option for lean-back viewing right away.

Having established the variety and expansiveness of streaming in 2025, we return to our initial question: What does premium mean?

Is it tentpole events like live sports? Anything and everything that’s viewed on Netflix? Or simply non-UGC, professionally produced content?

“We in the industry are over-defining it,” says Joseph Lerner, Head of Programmatic and Revenue Partnerships at Xumo. “We really need to allow customers to define what they view as premium. I personally view scripted TV shows like Blue Bloods as premium, which is available on FAST services, on Netflix, and on paid services. So if you start trying to dig into different platforms as defining it, it becomes challenging.”

In other words, premium is whatever we as viewers are choosing to watch. And in today’s reality of widespread content syndication across publishers, this is no longer exclusive to big-name streamers like Amazon Prime and Peacock.

Not All Programmatic CTV Is Created Equal

If we can agree that premium content is whatever your audience is watching, then it follows that marketers searching for premium content should be taking an audience-centric approach to media planning.

So does this mean abandoning content-based buying altogether? Not exactly.

“Audience-based and content-based targeting are so interwoven. I don’t think that you can ever break them apart and take one approach.” Says Xumo’s Joseph Lerner. “If you’re a brand, and you’re only thinking about the content that you’re delivering in, or you’re only thinking about the audience, you aren’t going to do your brand the service that it deserves.”

Luckily, programmatic buying can serve both ends. But when it comes to walled gardens, varying capabilities across each publisher make this easier said than done.

It's also worth mentioning that there are a few different ways programmatic CTV can be executed. These include:

- Open Auction. These ads are purchased in real time across available inventory, often at the lowest possible CPM. While scalable, this route can lack transparency and consistency in content quality.

- Private Marketplaces (PMP). Private marketplace deals gives advertisers access to premium inventory at negotiated floor prices, offering more control over where ads appear without locking in rigid delivery.

- Programmatic Guaranteed (PG). The programmatic guaranteed route combines the precision of programmatic with the predictability of direct deals. Inventory, pricing, and delivery are pre-negotiated, making this ideal for advertisers who want to align with specific publishers or content types at scale.

- Curated Auction Packages. As a hybrid approach, curated auctions give buyers access to a vetted selection of inventory that meets specific quality or contextual standards — making it an ideal choice for brands that want scale with built-in safeguards.

While different deal types open up possibilities, they also introduce complexity. That’s why it's essential to know not just what you're buying, but how you're buying it, and whether the partners in your tech stack can support this approach.

Nicole Scaglione, VP of CTV, OTT, and Online Video at PubMatic, explains:

“It’s not just about choosing between platforms. It’s about asking what you’re trying to achieve and selecting the right partners to curate inventory that aligns with those goals, whether that’s awareness, conversion, or anything in between.”

The Creative Stakes Are Higher in Premium Environments

CTV may have evolved into a high-performing, data-rich advertising channel. But its roots are still in storytelling.

Not long ago, CTV was treated like a digital version of linear: a place for memorable ads that build brand awareness. As programmatic technology matured, though, advertisers discovered it served other means. CTV isn’t just for broad reach — it can also deliver measurable outcomes at the bottom of the funnel thanks to its data-driven capabilities for targeting and optimization.

With this comes an interesting dichotomy.

PubMatic’s Nicole Scaglione explains:

“We have this inertia pulling us towards performance, but we can’t forget about the value and importance of that beautiful brand creative.

It’s important to remember why CTV is so important. It’s the groundwork that linear and broadcast TV laid for us decades ago. We can’t forget why TV (and CTV) are so special: That beautiful creative, that brand engagement, and that emotional connection with the viewer.”

Performance and storytelling shouldn’t be seen as mutually exclusive. In fact, in premium environments, the emotional connection matters more than ever.

Why? Viewers are more immersed, more engaged, and more likely to remember what they’ve seen. But the opposite is also true: A poorly produced ad is more likely to stand out for the wrong reasons when running alongside such high-quality content.

Fragmentation Presents Challenges

Even as CTV matures, fragmentation across the supply chain makes it anything but simple.

Each publisher comes with its own set of rules, limitations, and levels of transparency. Audience segments can’t always be applied universally. Measurement solutions vary. And stitching everything together requires a ton of elbow grease, integrations, and expertise.

As Lerner put it during the webinar:

“It would be really hard to apply the same audience segments across the 12 or 15 different publishers in a way that’s really seamless and makes sense. If you’re doing it all directly with those individual partners, it would be almost impossible to scale a campaign.”

Additionally, for buyers coming from linear, the lack of transparency in CTV can be jarring. That’s why it’s crucial to partner with platforms and providers that can unify disparate inventory sources — while offering transparency, measurability, and support along the way.

As Nicole Scaglione explains:

“Transparency can mean different things. In some cases, it's about understanding what show your ad ran against. In others, it's about getting the right signals to know that you're reaching the right audience even if the publisher doesn’t disclose every detail.”

In short, CTV success doesn’t always hinge on where your ads run. Oftentimes, what’s more crucial is finding a programmatic partner to help you navigate the fragmented ecosystem with ease.

Navigating the Complexity

Whether you’re a linear buyer moving to digital or a seasoned CTV strategist exploring premium placements, navigating this space takes extra legwork.

This isn’t to say you should go at it alone. But vetting your vendors is non-negotiable.

“The onus is on tech partners, publishers, sophisticated buying shops like Strategus to help demystify some of these scary complexities to actually demonstrate ‘this achieves your goal and here’s why,” says PubMatic’s Nicole Scaglione. “But it’s still a good idea for advertisers to ask their partners, ‘can you do this for me or do I have to know how to do that?’”

To that end, here are a few questions to ask as you evaluate vendors and platforms:

- Can you meet my spend, reach, and performance goals? Get clarity on whether your partner can deliver across the full funnel from awareness to action.

- What level of transparency do you offer? Ask about access to content-level data, contextual signals, and identity targeting options.

- Which measurement and attribution tools are supported? Understand which providers are integrated and which touchpoints can be tracked.

- What addressability capabilities are available? Confirm whether your partner can activate first-party data, apply audience segments across channels, and scale intelligently.

- Can you show examples of success with brands like mine? Ask for case studies. The right partner should be able to show real outcomes, not just impressions.

Stay Ahead of the Curve

Premium CTV isn’t a fixed definition. It’s a moving target shaped by platforms, viewers, and the strategies we use to reach them. The ecosystem is also always evolving, which is why staying informed is half the battle.

Want to keep up with the latest insights from the Strategus team and our network of partners?

Subscribe to our newsletter for ongoing guidance, collaborative conversations, and fresh perspectives on the future of programmatic CTV.

At Strategus, we help brands navigate this complexity with a vendor-agnostic approach that prioritizes audience connection over platform prestige. Our data-driven strategies ensure you're reaching the right viewers with the right message — whether they're watching on Netflix or a FAST channel.

Traci Ruether is a content marketing consultant specializing in video tech. With over a decade of experience leading content strategy, she takes a metrics-driven approach to storytelling that drives traffic to her clients' websites. Follow her on LinkedIn at linkedin.com/in/traci-ruether or learn more at traciruether.com.

Strategus is a managed services connected TV(CTV) advertising agency with over 60,000+ campaigns delivered. Find out how our experts can extend your team and drive the result that matter most.

Talk to an Expert

Table of Contents

Seeking a Custom CTV Strategy That Delivers?

What to read next

The Next Era of CTV: Insights From 10 Years of Growth & What's Next in 2026

CTV just turned 10. In that time, it has gone from a niche viewing behavior to the primary way people watch television. Streaming minutes now outpace...

14 minutes read

Pause and Effect: What Marketers Need to Know About CTV Pause Ads

Pause ads are one of the most promising new formats in Connected TV. When viewers hit pause, they’re focused, still, and more likely to notice what’s...

4 minutes read

Retail Media x CTV: What's Working Now & What's Next

Retail media is no longer an early experiment. It’s entering a phase of maturity where the players, strategies, and expectations have all evolved. In...

6 minutes read

Performance TV and the Role of Streaming

For decades, television advertising has focused on one thing: building broad brand awareness. Capturing viewers’ attention has always been the name...

7 minutes read